No private mortgage insurance (PMI), no down payment using your veterans eligibility certificate to buy a house…. Two pretty darn good reasons for going after a VA home loan.

Are you in the market to purchase a Maine home and in the dark on the best mortgage loan to fit your finances and match the home of your dreams? Considering a VA home loan may be the best mortgage product out there to lock and load for the shock and awe soldier. Keep your head down, your socks dry and skip the step about crawling on your belly like a reptile under barbed wire. At ease… VA home loans explained from A to Z in this real estate blog post.

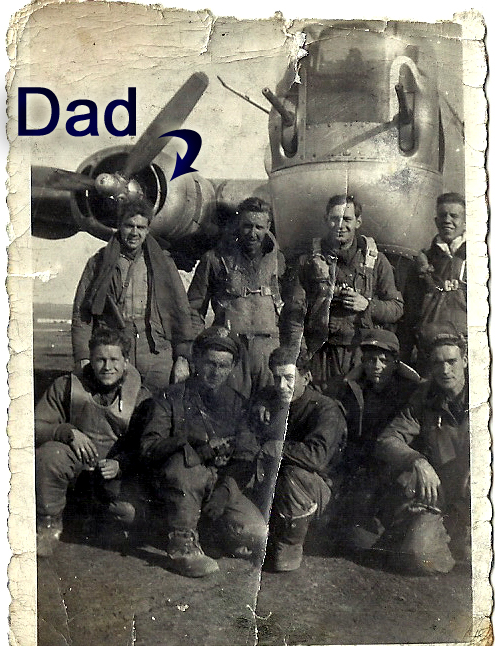

My Dad was a veteran, a tail gunner in a B-24 squeezed tight in the back end of the Liberator four engine aircraft during World War Two. I have two older brothers who served and are veterans.

Part of the benefits that are many to being a veteran is your ability to use a VA eligibility certificate to buy a home in Maine. But who is a veteran. For years I was told that serving in the National Guard did not mean you were able to get a VA home loan. So let’s thrash out who qualifies for a VA loan.

For starters, the all important discussion about who exactly is eligible for a VA mortgage home loan?

What’s it take to qualify. It starts with your answers to a few simple questions. Can you say yes to any one of the following questions to determine VA home loan eligibility?

1) Were you on active duty for at least 90 consecutive days during wartime?

2) Have you served at least 181 days of active duty during peacetime?

3) Did you serve in the National Guard or Reserves for more than 6 years?

4) Are you a widower or widow of a military service member who died either in the line of duty or as the result of an active-duty service-related injury or disability?

So far good if you are still standing and did you raise your hand or say “yes” to one of the four questions above?

What else to look forward to with a VA mortgage loan used to finance a home in Maine? The real estate closing costs are limited. By law, certain bank lending fees the rest of us non veterans have to pay are waived when you are a card carrying member of the service. And got out with an honorable discharge so you have the all important VA certificate safely stored away with your other valuable documents.

One more perk of a VA home loan I just thought of to share deals with new construction. The builder of the house in Maine new to you and never lived in too comes with a one year home warranty. The Maine home builder is required by federal law to provide this insurance coverage to the veteran home loan mortgagee!

(Disclaimer) The veteran who served in the American armed services, not another country is the subject of this loan program. Just so’s you know.

How many people use the VA home loan route to buy a house. Surprisingly, not as many are you would think.

I believe someone at the discharge station of veterans is not so hot at explaining the benefits of a VA home loan.

Or maybe the veteran was celebrating a little too party hardy the night before.

Excited about getting his or her discharge separation papers from Uncle Sam and the details on what they are entitled to on the outside from life in the service was just lost in the shuffle.

Still all in all, only a little over 10% of the roughly 22 million folks who served in one of the branches of the armed services uses their VA home loan mortgage option.

I think it is a combination of a banker remembering way back when the VA mortgage loan was a slow arduous process. Or maybe the veteran thinks save this VA no down payment loan for another house purchase down the road. You can reuse your VA home loan option though as long as you take care of any outstanding loan using this no down payment option to purchase a place.

Not pointing fingers at anyone in particular but the VA home loan seems to be a big dark mystery for many.

When we suggest this route in bank financing counseling for the best product fit for the property being considered, it is amazing how many veterans don’t jump on this VA home loan program. Instead heading into a Federal Housing Administration (FHA) home loan. I think one of the best options is a blend, a hybrid mortgage lending program that combines the best of the Veterans Administration loan and the first time home buyers Maine state housing loan.

Local banks in Maine are the best option and deal with the lender who is going to be or who already is your bank.

Close to the property means less time wasted communication with the mortgage center. The banker who understands the mortgage array of lending products will do the lion’s share of the local lending too. There is a perception out there on the grapevine that FHA home loans are easier to obtain. I don’t see that when compared with a VA loan that we have witness over and over as being one slick neat program that benefits those who serves in the army, navy, air force, coast guard, National Guard.

The VA home loan program, what are the basic ingredients for this lending option when you are shopping for a mortgage?

The VA home loan product like the Federal Housing Administration (FHA) program, the U.S. Department of Veterans Affairs doesn’t actually make loans. They stand behind them to back up partnership.

The VA backing is a guaranty if the veteran defaults on the Maine home loan.

If the veteran jumps ship or goes AWOL and ends up MIA, the VA will pay from 40 to 50 percent of the balance of the loan (the percentage depends on the size of the loan). This makes a lender on the home loan way way more relaxed and eager to approve the mortgage for the veteran. The bank needs that extra assurance for a no down payment home loan to an applicant that may not possess stellar credit. And lower than average income just getting out of the service and looking to better themselves in employment after the hitch with Uncle Sam’s offer to see the World and be all you can be.

What can you do with the VA home loan program if you qualify?

Buy land and build a home, buy an existing house or condo if the latter is in a VA approved community setting. The veteran can also buy a house needing repairs and rehab it. Or land a modular manufactured home on the land lot purchase.

If faced with an FHA or VA home loan, is one hard to qualify for than the other lending mortgage choice?

Not at all. Where did this myth that circulates around the members of the military and veteran groups start? There are a couple extra steps to getting a VA home loan but that does not make it overall easier to obtain a FHA mortgage approval. Find out if the lender you are considering has cranked out a few VA home loans. If their eyes avert yours and nervousness enters the room, you have the wrong home loan mortgage lender.

VA home loans, what’s the biggest advantage to sell a buyer on obtaining one?

The veteran does not have to put any money down for home loans under $417,000. Which is pretty easy to slider under that mortgage level living in rural Maine. Where buyer’s have a price point advantage here in the country that their city cousins enjoy.

To recap, another VA home loan advantage on your Maine home is there is no monthly mortgage insruance premium to roll into your house payment. Other conventional home loans with less than 20% down payments applied are obligated to purchase private mortgage insurance (PMI). And to keep paying it on top of the monthly amortizing mortgage payment until an appraisal shows the real estate value and equity are high enough to stop the added insurance expense.

PMI is designed to cover the lender if the borrower stops re-paying the loan for whatever reason.

Divorce, death, loss of employment, serving jail time are the biggest reasons for why that would happen.

A bad tenant in a property that does not make the monthly rent payment is another leading cause of mortgage loan default.

Even though most mortgage programs for lending prohibit the borrower from leasing out the premises, out in the real world it happens for economic survival when someone is forced to relocate. So no VA PMI needed. But when you chose the FHA home loan flavor to buy a Maine home that is secured by say a 3.5% interest rate amortized over a 30 year term, you can expect another .85% extra for PMI added into your house payment. To be combined with the escrowed property insurance and annual tax amount divided by twelve each month.

Why VA loans for home mortgages are not used more?

It just dawned on me the eligibility amount. The VA certificate that gets tucked away or lost spells out a dollar amount. Often $27,500 was a number I remember seeing years ago when a veteran would stop into the office to look over the housing inventory. It spelled out as the guaranty. And maybe that is why the veteran home buyer figures they don’t have enough so let’s find another house purchasing solution for finnancing.

The $27,500 or $36,000 printed on the Certificate of Eligility (COE) refers to the basic entitilement portion. This is the VA’s maximum gurantee for home mortgage loans up to $144,000. But talk with someone who has a few VA home loans under their belt when getting financial counseling. The bonus entiitlement adds in another $68,250. And in certain counties of your state the figure can be even higher. It is flattering to have someone tell you what you qualify for is higher than you thought. But still, having money left over beyond your house payment each month is a good thing. Mainer’s are frugal, don’t want to lose their home and live below their means.

Again, the VA loan has no monthly mortgage insurance premiums, closing costs are limited, there is no prepayment penalty if you accelerate the amortization schedule.

Or sell it to pay off the mortage early to buy another place or just hand it up to head into a rental arrangement. No monthly mortgage insurance premium means the veteran’s monthly house payment will be smaller than if he or she had picked the FHA mortgage home loan route.

More paperwork and obstacles, what ares the added steps in a VA home loan mortgage? To be found eligibility for a VA mortgage loan you must plan to live in the home not rent it out. You have to have decent credit and your FICO score could be as low as 620 for a VA loan. The VA home loan does For your own good, proving you have sufficient income to cover your monthly bills and house payment needs to be demonstrated. And if you lost your VA Certificate of Eligibility (COE), it is not a big deal to get another one issued. But most VA-approved lenders can access your COE online.

The VA website helps you access your COE and provides a whole lot of other information on the programs available because you are a US veteran.

Ten hut. Double time hut hut hut to your local lender to get pre-approved maneuvers started soldiers before getting too deep in the house hunting. And get stung by friendly fire when credit, whatever other factors make you 4 F unfit for financial mortgage underwriting.

One of the biggest hurdles for vets is that these loans are provided by a slew lending providers.

They all have their own peculiar guidelines. Best to shop around until you find one that you feel is the best fit to partner up with and continue to use for your other banking needs now and down the road. More on VA housing benefits.

How fast can the VA home loan program get you out of the rent rut foxhole and into your comfy new house? Where you eat real meals, not MRE’s under the star filled sky.

Lots of factors impact the lending process like is the home empty or will the seller or tenant make it that way so you can close. Who is the lawyer or title company and are their hassles with the legal end of the property examination? Like a pesky right of way or shared well or some encroachment?

How long is the VA appraiser going to take once the appraisal is ordered? Like other appraisers nationally, there is a shortage of the guys and gals that check the property over and arrive at today’s current value. The repairs needed and the follow up check to make sure they were done and correctly all eats into the time the loan sits in processing. But I remember one army recruiter that we zipped through mortgage underwriting in 22 days. Everything has to work just so and the standard six to eight weeks is a good plan to accept when considered how long is this home buying process going to take?

Is there a minimum mortgage amount for VA home loans?

The VA will guarantee up to 50 percent of a home mortgage loan up to $45,000. For loans on homes priced between $45,000 and $144,000, the minimum guaranty amount is $22,500. The maximum guaranty, up to 40 percent of the loan on the house up to $36,000 is subject to the amount of entitlement a veteran has available. More on property requirements for a VA home loan standards to be aware of beyond just safe and healthy conditions like any other mortgage underwriter expects.

Here to talk, we start by listening first. Taking very good real estate notes. Then providing helpful advice for each special housing situation. This blog post topic giving information about Veteran Administration (VA) home loans. Lots of other topics to discuss! Are you buying or selling and thinking you need a real estate professional in Maine? It is a privilege, would be an honor to serve you applying our 38 years of service history to Maine home buyers and sellers.

I’m Maine REALTOR Andrew Mooers, ME Broker

207.532.6573 | info@mooersrealty.com |

MOOERS REALTY 69 Nortth ST Houlton ME 04730 USA