Local Maine real estate market report, what the property listings and sales numbers show for a trend.

This blog post is about the current Maine housing market. New listings, sold data, how long a typical house sale is taking in Maine today. How individual areas of Maine’s real estate market are percolating and why they are behaving that way. Too early yet, it remains to be seen what the Coronavirus COVID-19 will do to the next Maine real estate market report.

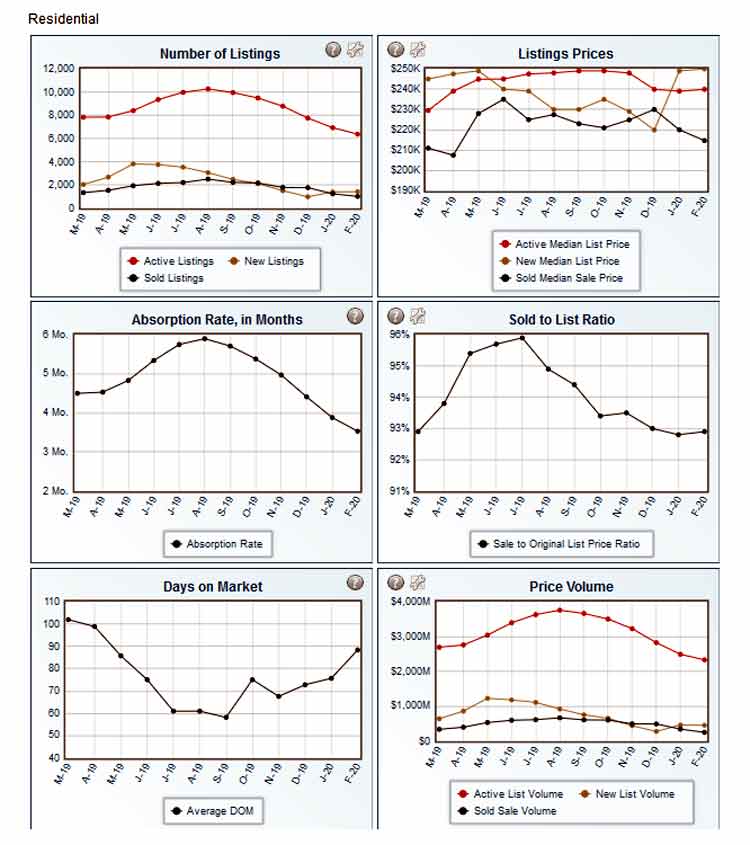

The average list price for Maine real estate residential listings is year to date up 7.32%. The supply of inventory was 4.8 months worth on the statewide MLS conveyor belt a year ago. Today that cookie jar is down to 3.71 months of real estate residential listings. The sales price for Maine houses is up 3.82% for single family residences. But stay tuned for how the Coronavirus and counter measures impact those numbers we report on in the next blog post installment.

Today looking back over our shoulder the last twelve months, statewide residential housing listing numbers show the DOM (days on market) is down 17.35%. The home listings are taking less time to slide over from the pick me please, I’m available into the SOLD column.

Maine has lots of affordable housing inventory but local jobs for people to make the payments is always part of the two step dance music that is happy, sad or “meh” in between.

Employment opportunities, the local pay scale and hourly wage play a huge part in keepinng the lid on the single family housing market. How things shake, rattle and roll in just the residential category of Maine real estate listing sales today is what you will get in this market report blog post. That kind of news is very important to home buyers, house sellers, investors, bank appraisers, government officials, the agents and brokers working hard day and night down in the trenches.

The strength or weakness of the local Maine real estate market affects a person’s life and financial health.

Serious stuff. It is not like just small talk banter to fill time about the weather in conversations either. How long is it taking to sell a house in Maine? What are Maine homes selling for today? Everywhere the real estate professional goes in their travels, the same important question gets asked over and over. How’s the Maine real estate market today? People want to know. The local media tries to give it attention but a clever sound bite, a less than 30 second synopsis does not do it justice.

The real estate market report is pertinent to where you live and the same forecast in the greater Portland metro does not play out so well in St Agatha or Vanceboro or Greenville Maine housing market.

Active, under contract, an increase or decrease in supply of real estate housing listings is used like a doctor or nurse monitors a patient. Your real estate home listing lives and breathes in a unique set of market conditions wherever it is in Maine and this market report information is vital.

To know when you the seller should make a price reduction to help the process and not wait for one brave soul to make an offer to get you to consider taking less to get to a real estate closing for a sale. The real estate market absorption rate, when there is a healthy six month supply of inventory you look at pricing one way. When the absorption rate shows a shortage or glut of listings. That important statistic signals what to expect ahead and dictates what needs to be done with the property pricing to cause it to sell when others do not.

Real estate market report statisitics always fill columns county by county in Maine with the actual sold price compared to the listing figure.

The one tacked on to the home in the beginning of the process and that proactive sellers and agents / broker hopefully adjust a tad along the way. That ratio number also is all important to know what the current Maine real estate market is looking like and what your buyer or seller should know to make moves in it. When home listings are flying off the shelf, when multiple offer situations and bidding wars occur, that behavior says something about the current housing market in Maine.

If I am an investor eyeballing Maine real estate market listing inventory, there is a time to sit it out or dive right in.

What to the current set of statisical numbers say for what is happening with the real estate inventory numbers. All of them. I need to know the numbers, like ordering take out for the eat and run and all the white containers with the good stuff hidden inside.  To study the real estate market ratios and know about plant closings or employment expansion that affects the Maine real estate market.

To study the real estate market ratios and know about plant closings or employment expansion that affects the Maine real estate market.

The house fix and flip real estate investor helps the first time home buyer because they buy low, inject just the right amount of TLC and repair for a return on their investment. Making the home that is below minimum mortgage loan program housing standards to get a loan bought back on its feet. So that never owned a house before buyer with nothing in his or her price range can climb out of the rent rut. To become part of the local community and have something affordable to begin home ownership for his and her family.

Investors considering Maine properties need to know what the six month or a year from now local real estate market is going to look like down the road.

Based on what the current one is showing for housing inventory, list to sale price ratio, days on market, the absorption rate and what economic factors are going on behind the scenes that shape what’s up ahead. The out of state investor from outside the market area who knows his location backwards and forwards can not use the same logic in one of Maine’s real estate locations. Gut feelings and playing a hunch is not the way your investor makes smart decisions in the local property listing markets around Vacationland.

Maine real estate investors study the current numbers.

They rely on local agents, brokers, Maine REALTORS. Property investors if they are gonna buyer demand accurate real estate marketing statistics from Maine Listings, the clearing house for single family residential sales. Not from on town assessed numbers collected for tax raising reasons many years ago and not reflective of today’s real estate market. Also, not on an algorithm from RTZ that pretends to be a wizard at pulling real estate values out of thin air from out on the west coast. Some people, not many sharp real estate professionals believe in that voo doo shame on you approach to what’s my property in Maine worth today. Wildly way off numbers touted as gospel and public facing based on very limited tax assessments, built on wrong information that some sadly use to make very costly deeply flawed decisions is a sad situation.

Today in Maine, statewide as a whole single family residential housing sales are up, inventory was down.

Here below is the health chart from the statewide Maine MLS clipboard that tells the tale today for all of Vacationland.

That’s the appetizer because I know you are hungry for and I sense the mouse trigger finger is twitching, getting itchy to flit. A real estate marketing report article or blog post better clearly reflect what is currently trending in the residential single family housing arena right here and now. Adding in a peek over your shoulder reflection of the real estate market that played out a year ago in the beginning of this blog post. Combining the two with the month by month, back and forth highlights of each real estate market all reported in an easy to understand information transfer. Sold listings are up 13% and sale pending under contract numbers are up 7.4% year to date. In Maine, active listings for single family residential numbers are down 14.3%. The new housing unit listings volume dropped 1.4% YTD. These are hot out of the oven Maine Listings fresh baked MLS statistics as of today, March 14, 2020.

Simple words, plenty of helpful bar graphs and hit me with a couple of Maine real estate market line chart illustrations.

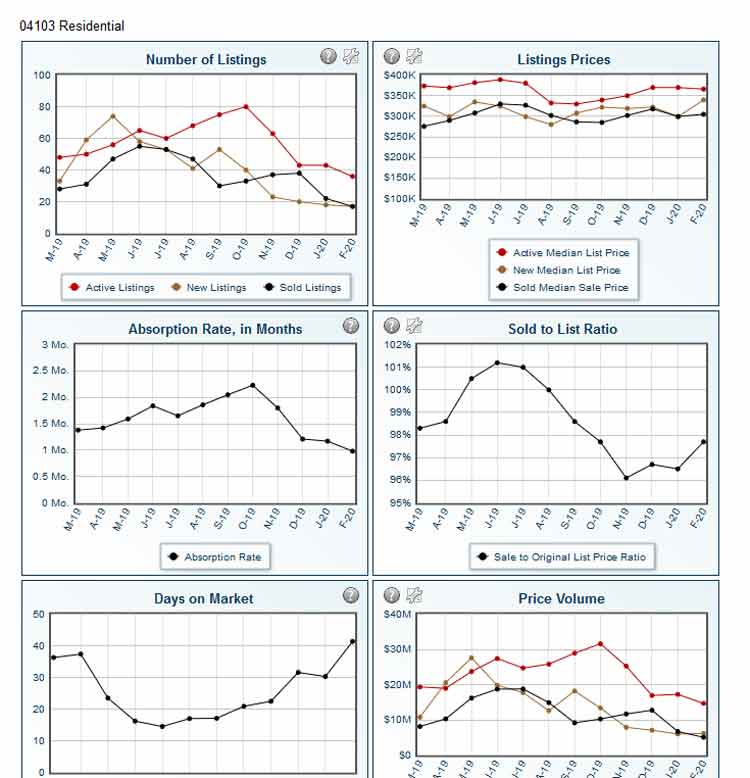

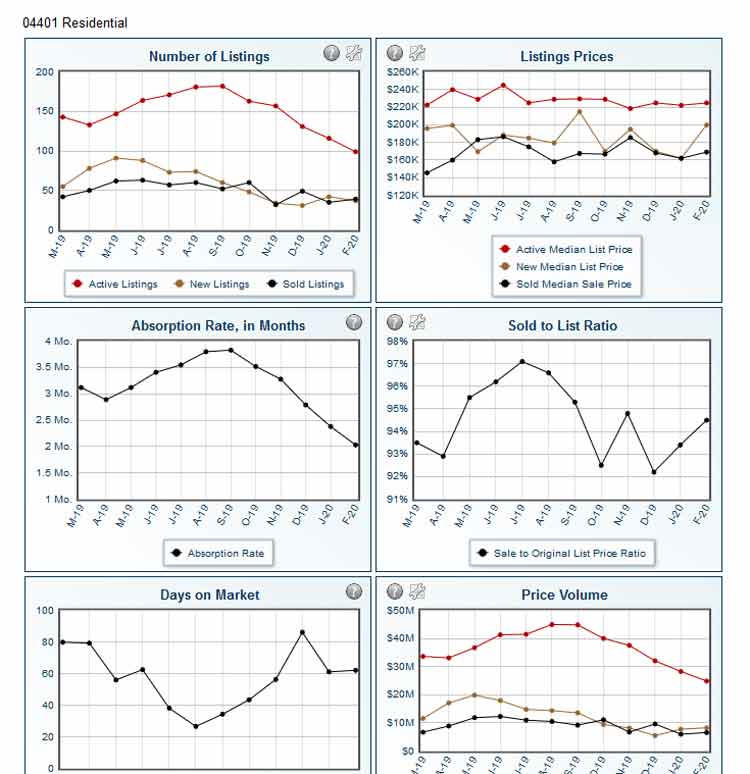

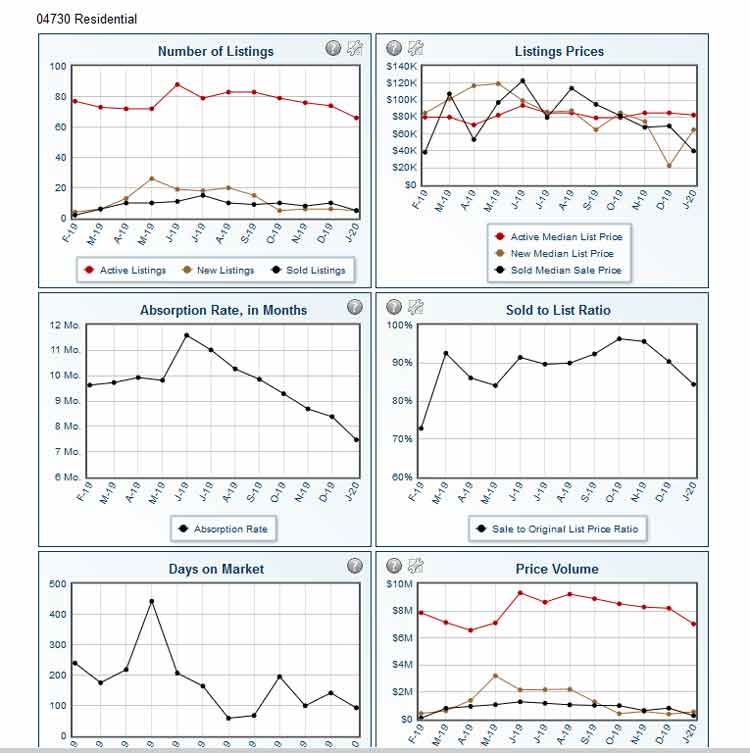

Check this out how a closer look for a few sections of the state of Maine pans out differently when you drill down in and mine from the current listing sales statisitics.

This is the largest Portland Maine zip code real estate market report segment for today’s blog post.

Now take a peek and compare the same Maine real estate market but the zip code the lines go up and down to represent is Bangor Maine’s zip code.

And to bring it all home as Johnny Cash would remind his back up band musicians, let’s spotlight my Houlton Maine 04730 real estate market zip code.

Stark differences in the price, the days on market, the absorbtion rate activity and what’s hot, what’s not. Maine has one area code, just 207 does the job for the entire state. But one market report for a single area of real estate would not work in another county or metro area zip code.

The small town rural areas of Maine which is the bulk of geography compared to the handful of city urban real estate market pockets shows the sharp contrast.

The guy or gal reporting the real estate news always knowing if you get too bogged down in the details, you lose the audience quickly. If the scope of the single family residential real estate market report is too broad, it can be too watered down and all over the place. Hard to glean any worthwhile information. Like some people who suddenly go into a sleepy mode when shopping pushing the wire cart with the one bad wheel. The attention is harder to keep when spitting out percentages and using latin like real estate terms or a bunch of letters that most tuned in have no clue what they mean.

The current Maine real estate market numbers from the listing sales showed a strong market, prices holding and inventory building but down due to winter slack.

Some believe the myth nothing sells when snow is on the ground which is not the case and our office continues to be very busy. What the all out attention to the Coronavirus, shortage of toilet paper and cancellations of travel and bigger events will do will be released as that effect infects the real estate market numbers in the days and weeks ahead.

This was the last real estate market in Maine news report on this channel the tail end of January, 2020.

It was more of the same but the Coronavirus will throw a wrench into the real estate market momentum and slow the flywheel speed. Or our remote nature and desire to get space and not catch the virus may make Maine the location to buy and move to.. we shall see and report the same. Here the latest from the state of Maine coronovirus reporting statistics and closing measures, what’s being done to do our part in containing the spread.

Where I live in rural Maine there are no condos, townhouses, no high rise cooperative apartment inventory and it is not just single family homes we list and sell.

I will leave land sales, small mom and pop commercial listing sales market reporting for another day at the keyboard. This real estate market report drills down into home sales activity statewide using current statistics. But remember that home sale prices and units sold in the Portland metro real estate market numbers don’t match so so many other localities in mostly small town rural Maine. One size does not fit all in a state as tall and wide as Maine where all real estate values increase the closer you get to the coastal regions or those areas handy to higher priced, closer to population centers in extreme southern Maine.

The numbers for single family home sales can always be sliced and diced further.

What segment of those home sales in Maine are second homes for vacation use and rented out not lived in year round by a local family? Does it matter? It sure does to an appraiser who is trying to correlate what he or she has to value that needs to distill down the figures to sort out what he needs for compatibles in listings and sales. And the appraisal comps are time and location sensitive. Usually have to be current listings not expired one and sales from a year back or less unless permission to go back further for lack of comps is okayed by the mortgage lender loan underwriters. Also extension beyond the geographical marketing area of the subject home being eyeballed in the appraisal valuation has to be justified by study of the numbers.

All this same information is helpful to the buyer or seller looking for a particular type of single family residential home in their specific real estate market location.

Yes, it can be argued that the market buyers today will let you know if a property is over priced or not as the days on market number increases. But when listing a property, knowing today what is the market value and where should we price this home listing to be competitive and right on the money is critical. Time is money. Over priced properties starting off in the wrong real estate market price point end up selling for less when and if they ever do get to a real estate closing.

The size of listing and sale prices in Maine are night and day from southern sections compared to northern interior figures.

Coastal Maine single family home sales are a whole different animal too. Waterfront properties are always in demand and more often than not in short supply. Housing stats data for Maine real estate single family home sales is not a one size fits all. So we cover the state of Maine as a whole, then check in with other area activity, prices, supply inventory details to round it out for something useful.

How are we doing, how do these numbers stack up in time? The focus on then and now, dry to many statistical real estate market numbers smashed together over a specific time period is critical. So the average Jane and Joe Doe learn loud and clear without a doubt know where is the real estate market today. The median home values, price per square foot numbers, interest lending rates, days on market, list to sale price ratios, the weather, etc. All those bar graphs and squiggly line numbers of listings and sales tell an important story.

But the marketing statistics can be dry as all those popcorn balls you collected trick or treating as a kid.

Most of mine got tossed in the circular file and what I really wanted for treats were the Nestle Crunch and Paydays candy bars to eat and trade. No one wanted the stale  boring popcorn balls drier than the dessert of Maine. The causes of the up, down, or staying the same flat market vital statistics can be pretty delivered in a refreshing way. It just takes adding some salt and pepper seasoning that takes best with experience in the market reflection. Only someone that has worked in the hot and cold Maine real estate markets can report from experience best.

boring popcorn balls drier than the dessert of Maine. The causes of the up, down, or staying the same flat market vital statistics can be pretty delivered in a refreshing way. It just takes adding some salt and pepper seasoning that takes best with experience in the market reflection. Only someone that has worked in the hot and cold Maine real estate markets can report from experience best.

But with a state as vast and spread out rural as Maine, feeling for a real estate market pulse makes it a challenge. Pouring over the current numbers are helpful. But every new day is a challenge and change is a certainity. The coronavirus and it’s effect and the Maine real estate market’s reaction to whatever government travel sanctions are imposed will no doubt impact the new blog post about what the next set of MLS numbers reveal.

Maine’s remote location, vast size and ability to keep your distance and buy low cost real estate may prove to be a big perk.

For those real estate buyers looking to live on less in the middle of four season natural beauty. It is not hard to maintain the six feet away personal protection bubble in rural Maine where it’s eleven people per square mile or less. Fear drives relocation to begin again, to raise your family in a healthier part of the country and for safe, lower cost retirement options that Maine offers so well.

The next Maine real estate market report weigh in will definitely address how the coronavirus impacts our listing inventory supply and pricing county by county. Something like the coronavirus, much like interest rate increases or reductions impacts the Maine real estate market behavior.

As I do in all the published articles reporting on the current real estate, this blog post warns not to try to apply what is happening in Portland to all parts of Maine.

The same house selling in southern, more populated Maine for $220,000 will only set you back $70,000 in other more rural state locations. Discount and dissect accordingly to know it is so so important to clearly indicate which area of Maine’s real estate market are you hearing numbers on before making it one size fits all. It does not like the many weather regions Maine has that all perform different on a give hour in any day.

Thanking you for reading this blog post on the current Maine real estate market.The next one will no doubt about it will move into spring season developments, the coronavirus impact, interest rates, local employment gains or losses that all affect the Maine single family residential real estate market numbers.