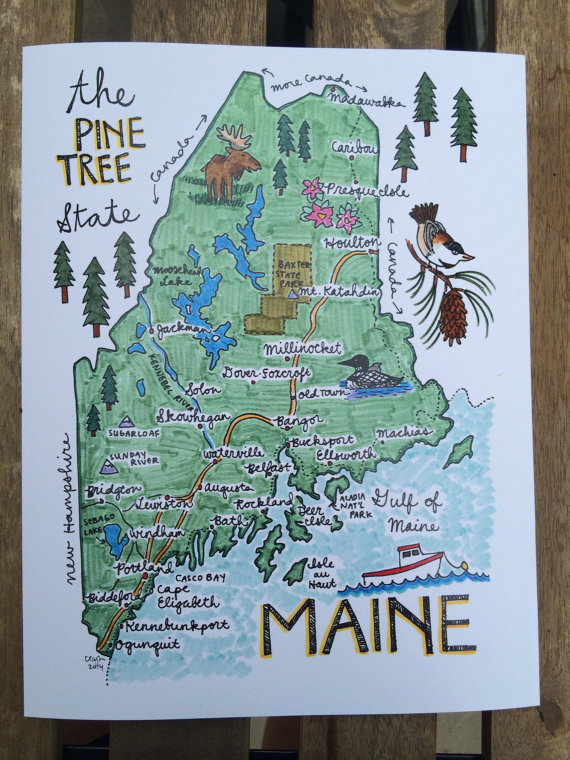

You are eye-balling a property listing, some Maine real estate and the question comes up about flood insurance.

Do you need flood insurance or is the property in a designated flooplain? Time to bone up on the terminology! A floodplain is a region next to the waterfront that swells and the real estate is affected from high dischanges of water.

How do you tell if a property for sale is affected by flooding, if it is in the floodplain? Check out the flood zones from the FEMA maps. More on the purpose of flood insurance and why it is needed in some cases. Homeowner’s, renter’s insurance do not typically cover flood damage. Flood damage is one of the most common natural disasters that can wipe out the home sweet home pretty picture.

Sure hurricanes, tornadoes, hail and winter storms can ravage a Maine house and the land around it.

But floods, the force of runaway water gaining speed and volume causes extensive damage. That unlike a freak hail storm where one exterior wall of vinyl siding needs replacement, floods can cause major soil erosion, sweeping a structure down a river to end up at a new property address. Or mold, water logged floors, furnaces under water that were not built to operate in those condition, damage from trees uprooted and slamming down on a roof all make the fix and repair from flood damage highly costly.

Also, flooding can re-occur year after year unlike lightning strikes or a gale force windstorm repeating the toll on a property. The cost for flood insurance protection would be too high for the average home owner to carry coverage against so Uncle Sam stepped in to the picture. To provide coverage so lending institutions will write mortgages on the real estate.

More than twenty percent of flood damage clains happen to areas outside the floodplaine too. So accurate flood maps are key and being able to determine if flooding does not happen yearly, predicting when it will happen is so important.

In my Maine real estate area of practice, the FEMA (Federal Emergency Management Agency) maps are studied when listing a waterfront property. Something on the river, bordering a pond or lake, backed up against a stream.

The FEMA maps made years ago and not updated is the problem.

Inaccurate information is a bigger deal than the threat of flooding because many lake properties especially appear on the maps as in the floodplain. But walking the waterfront lot terrain indicates this lot should not be designated as in the floodplain when the level with the shoreline one next door is another story. Eyeballing the lot with no elevation and concern about the floodplain is removed when the FEMA maps show the land is not in harms way according to the FEMA maps.

So what happens if the priority in rural Maine is FEMA floodplain map updates to make them accurate is not in the budget? How does a property not actually in the floodplain designation get out of the red zone cross hairs that cause an expensive policy to be needed to get it financed?

Call in the local Maine land surveyor.

To set up the transit, to collect the data and compass points and put pen to paper.

To create a survey that addresses the million dollar question. Is the land in Maine, the lot the improvements if any are sitting on in the floodplain or not? The request for an exception from the floodplain map designation that you says you are when in reality you are not is needed.

What is the cost for the exeption request which may end up determining you really are where the FEMA maps indicate, in the floodplain?

Ask your local surveyor, get estimates from more than one and learn the norm for the expense in the particular area of Maine where the real estate is located.

I have seen a home for sale where the residence is not in the floodplain but the garage or extra buildings a ways away from it are. Getting financing on the home and land and excluding the area where the FEMA maps show flooding is predicted is one solution.

The appraiser is going to study the home, the land and improvements it sits on and come up with an estimate of value to show the bank the collateral is sufficient to make this loan. Or no, part of the value is missing because the extra land, buildings, whatever improvements or structures are needed to justify the total sale price.

Flood insurance how do you purchase it, what does it cost, do I really need it?

If it is determined you are in a high or low risk area where it is needed, because a bank program demands it as a contingency of the loan. You can call a local insurance provider and add the additional coverage to protect against flooding. More on the National Flood Insurance Program. You can not buy flood insurance directly from NFIP and need a local insurance agent or broker. Even if a President declares a national disaster involving flooding, the insurance coverage may still apply and be received to recoup on damages from Mother Nature.

Most federal disaster assistance comes in the form of low-interest disaster loans from U.S. Small Business Administration (SBA). You have to pay them back. I have seen a home buyer purchase costly flood insurance to just to get the closing to happen. Then been told by the buyer later that they were not going to continue with the yearly premiums.

Not sure what happens with that Mexican stand off if you stop paying for the flood insurance coverage.

Just saying I have heard that through the grapevine.

Not recommending that procedure because anything that is a continency of the mortgage loan until it is paid off and discharged is gospel. And could lead to a bank taking action to enforce what is spelled out in all those pages of fine print that you signed and initialed at the real estate closing.

FEMA offers disaster grants that don’t need to be paid back, but this amount is often much less than what is needed to recover and repair to make everything as close to what it was before the flooding.

A claim against your flood insurance policy could and often does, provide more funds for recovery than those you could qualify for from FEMA or the SBA–and you don’t have to pay it back is what I am told from study of the flood insurance issue.

The cost of flood insurance is figured based on lots of factors. The age of the building, the number of floors, the level of flood risk and the amount of coverage you the homeowner need to secure to please the bank mortgage lender. The flood insurance premiums are calculated based on the location and flood zone, the design and age of the property, if the area is designated high, medium or low risk.

Lots of expensive items in a home are not covered by the FEMA flood coverage policy.

You the homeowner would need to purchase additional coverage for food freezers, what’s in them. For those portable air conditions, curtains, clothing, furniture and electronic equipment.

Is the 100 year storm the only fear to cover or is year after year what to expect for flooding? Fort Fairfield ME was built in the wrong location and with dikes, with ice breaking during spring thaw, the community remains. But a better location could have been selected a little higher up to get above the waterline during spring flooding.

Luckily none of the property I list, market, sell is parked next to something as large as say the Mississippi River with the potential for major flooding. Most of what we deal with is FEMA floodplain maps needing updates to be accurate and people purchasing the real estate affected by legitimate potential flooding issues find alternate financing. Through say the seller where the property owner is not demanding as a term of purchase to be the evidence of floodplain coverage. Kept current annually with notice of the same until the mortgage loan is paid off and the real estate is free and clear. Hope this blog post on flood insurance on Maine real estate is helpful to you!

I’m ME REALTOR Andrew Mooers, Maine Real Estate Broker

207.532.6573 | info@mooersrealty.com |

MOOERS REALTY 69 North ST Houlton ME 04730 USA