Owner financed Maine land.

This Maine blog post explains what buying and selling land looks like when an owner of it holds the mortgage. Owner financed Maine land.

Why is finding a property seller willing to hold the paper, to take back a mortgage on the land in Maine you are buying so popular?

Lots of reasons really. Maine land is low cost, big and beautiful. First and foremost to that, the country we live in is built on installment sale payments right?

What’s one more monthly payment added in on owner financed Maine land?

To squeeze out of the household income a little slice for some land in Maine. That sort of thinking happens a lot.

The Maine land is an investment and often used for a cheap vacation destination in the state where the bottom of all the license plates say “Vacationland”. Maybe the owner financed Maine land buyer wants to farm and live off the bounty of the dirt. To heat with wood, a renewable resource that is another perk of owning forestry timber land to selectively log and thin for profit.

Why else do many Maine land listings so often come with a seller willing to offer owner financing?

Because the seller does not need to replace the land like most do when listing a house. The home for sale might have a mortgage that has a ticking clause in the fine print. The legal clause about if you try to transfer interest in this collateral, or attempt to let someone take over the unassumable loan, an acceleration device is detonated. The bright lights come on, the sirens go off. All the money owed becomes due. Not now but right NOW happens.

With a house, you usually do need to replace the sticks and bricks with another one.

Unless it is your last set of house keys to the home sweet home. If you are headed into apartment, assisted living or maybe a nursing home. When you are in the sunset stage of living, monthly owner financing installments trickle in too slowly.

And the seller worries about what if the owner financed home buyer does not keep up his or her end of the bargain and stops paying? Those inheriting the assets if there are any will have to foreclose on the real estate mortgage. Any home owner has to do maintenance on it and when they don’t, the value goes south as the property condition heads down hill too. With Maine land, look mom, no structures, nothing to maintain… just let the woods grow or keep those pasture fields hayed and tilled to raise something. But lots to construct something on Maine land, building a home.

What’s another reason that Maine land is most often owner financed unlike other types of real estate? Banks are not hand stand happy about making Maine land loans.

Those kind of mortgages can not be packaged up neat and pretty to dump on the secondary market. Banks making Maine land loans don’t have the same luxury of selling off and getting rid of the discounted mortgage paper to investors like they do daily with a home’s promissory note. You know, the one you signed at the “mortgage your life away” long tedious real estate closing that cramped your hand from the tall stack of paperwork. The real estate closing where you learn your final payment, the mortgage burning party is a fast forward to fifteen, twenty, thirty or more years from now.

Owner financed Maine land is often bought by a group of sports men, family members who like to hang out with each other “up tah camp in Maine”.

When the resources are pooled, that monthly owner financing payment on the Maine land is a piece of cake to make. To use collectively all year round for vacations when each can fit them in to head to Vacationland. The group puts their skill sets together to create a vacation property to enjoy all that Maine offers year round.

When there is a group making the owner financed Maine land payment.. you get more size for less acreage price.

Each buying member does not even feel it when divided up between many who will enjoy the big chunk of private, scenic super sized Maine land acreage.

Plus those same individuals on the hunt, fishing around for land in Maine have skills. To help frame the camp or cabin. To wire up and plumb or shingle or make weather tight the vacation paradise in Maine.

Back to banks, don’t get me wrong. Maine banks will finance land, but the down payment is hefty, the terms are steeper than on simple house loans they put together.

If the bank or credit union is going to hold the mortgage until the Maine land loan is paid off without the ability to sell it off to a third party investor for a discount hit and run. The terms on Maine land the lender charges to make it worth their while happens. Packaging up the mortgage for the secondary market on Maine land loans to dump it is not how property acreage financing works. The bank is left holding the paper and has exposure risk for years and years with Maine land loans.

Can you say up to forty percent down payment for Maine land loans if you use a bank not the owner?

Sure you can. I knew you could. Bank fees come with Maine land loans made in those conference rooms. The ones with the long table closings that happen to the left or right of the big main tile floor high traffic lobby.

With owner financed Maine land, getting a seller to consider doing it is big hurdle. Many don’t spit out this much percentage down or monthly interest rates they expect like an accountant might. But the Maine land buyer is the most important part of this buy / sell partnership that is home grown without a bank involved.

How much can the Maine land buyer handle for a down payment?

What monthly installment can they make with ease as they check off the payment numbers on the amortization chart provided for the buyer and seller to follow?

As the Maine real estate broker listing and selling for forty one years, I don’t want to get the call from the buyer that lets me know don’t expect this month’s payment to be right on time.

Sharing that sad news with the seller and staying involved to get the buyer back on the payment schedule track should not happen if the owner financed Maine land sale is set up correctly. We set them up not to fail so it is win win for bother Maine land buyer and seller.

In the counseling with the Maine land buyer the mortgagee is instructed to not make promises of a payment larger than they can comfortably deliver on month after month until the land loan is payed off. When the property mortgaged becomes free and clear.

If the seller of the Maine land does not need the money, setting up owner financing with a healthy interest rate return figured into the payment make the property sale like an annuity.

That monthly payment is looked forward to and helps out their monthly expenses or increases their savings. The interest rate charges is better than their low yield bank savings account spits out but is still more attractive to the land buyer than what a bank would levy.

What happens if the buyer of the owner financed Maine land can not pay?

If a major life event happens that makes continuing payments a hardship or no longer possible, we list and sell the land. If a few years of payments have been paid in, if the buyer has drilled a well, put in a septic system and installed power or built a cabin, the land value with those improvements has gone up to allow a sale. What’s owned has done down with time ticking by each month they did make their payments without a hitch.

If the buyer dies, the estate may stilll want to hang onto the land and divvy it up between the heirs if there is money from other assets to keep that dream up in Maine alive.

When a seller opts to provide owner financing, there are lots of rules in the mortgage and promissory note about what the buyer can and is not allowed to do to the Maine land. As long as there is a mortgage on the land, no cutting of the woods or committing waste can happen without the written permission of the Maine land owner.

Cleaning up blow downs or trimming dead sections of trees is like grooming. It is tree farming to maximize the growth by removing a little over story here to let the little guys down below get a bath of healthy sunlight. To get out of the damp dark lower region of the forest land. Major cutting would have to be overseen by a licensed Maine forester if the seller of the Maine land agrees to such an arrangement. The wood removal is hurting the value of the land if done too heavy or not with good stewardship practives involved.

Constructing a good access driveway road into the Maine land or creating a clearing where gravel is hauled in and smoothed out for a building site. That’s all encouraged on owner financed Maine land.

It is an improvement that increases the usability of the Maine land. Which adds value to the collateral of the property acreage that is being a month at a time paid off slowly.

Owner financed Maine land.

No pre-payment penalty to settle up and retire the mortgage early happens in 99.9% of the hundreds and hundreds of owner financed Maine land loans our office set up over the years.

The larger installment annual lump sum balloon payments to pick up the pay down pace, or to just cash out the mortgage early from one big lump sum should be encouraged setting up seller financed land loans. But keep whatever you do as buyer and seller tied strictly to the amortization schedule to know where everyone is in the loan payment schedule.

If the Maine land buyer wants to throw in an extra hundred dollars now and then when writing the checks to the seller, that is going to mess up the original amortization schedule.

The bigger payment lump sum cash infusions have to be done by adding up the principle amount figures.. the exact numbers owned each month on that original amortization schedule. The one that the buyer and seller received copies of at the real estate closing for each to write down when they made and received those month to month payments.

The Maine land loan amortization schedule is like sheet music so everyone is singing on key.

Not missing a note or having to hum any of the words to the Maine land owner financing method to assure a happy ending for both buyer and seller partnership. The amortization schedule is an intricate part of the record keeping so both buyer and seller know how much has been paid in, what remaining balance is still outstanding to chip away at.

If you are trying to avoid the extra costs of a bank lender by dealing direct with the owner of a Maine land parcel, owner financing is one custom made way to do it.

But if you intend to borrow money to build a home down the road, remember that the bank you go to secure that money to build is going to want to get rid of the seller who holds the mortgage to the land under that new house.

The bank will want to be secure with the first mortgage position on the land in Maine under that improvement that they gave you the money to build.

If they have to yank it back in foreclosure, the financial institution needs to have solid footing on the real estate whatever was added for value and utility on the Maine land.

If they have to yank it back in foreclosure, the financial institution needs to have solid footing on the real estate whatever was added for value and utility on the Maine land.

Banks don’t want to loan on structures if they are on leased land unless the lease term is as long or beyond the mortgage loan period.

With building on Maine land that has a seller mortgage purchase plan underway, there is one option to please the bank.

If the seller of the owner financed Maine land will except and reserve say one or two acres of for construction.

To make it free and clear of the land owner mortgage left in place on the rest of what you bought for acreage.

So the bank can place a mortgage on that building site chunk of land.

The excluded house lot may be two acres or whatever the minimum lot size the local municipality dictates for the amount of land needed for any new house built on it.

Everything has to be to today’s standards to comply with local zoning standards.

So the mortgage lender with the lien on the house lot and whatever you build, what was added for well or septic or auxiliary buildings. That lender can foreclose to recoup the bank lenders investment and move on. Knowing these foreclosures happen from time and expecting them.

In the case of private water and sewer, particular care by the lender will be taken to make sure the well and septic, the driveway, all the set backs fit nicely on the free and clear piece of land set aside for the dwelling. So a soil test right away to know the leach field, side line set backs, the well can all fit nicely on the house lot you create.

In my area, ninety nine percent of the owner financing situations I am involved with is a seller providing the deed to the land and taking back a first mortgage lien on whatever is conveyed.

The buyer signs a promissory note and agrees to the mortgage terms on interest rate, the term for payments and all the legal boiler plate language about agreeing to not commit waste, keep the property taxes current. And if their are buildings on the land being mortgaged by the land owner, the provision for proof of insurance unless impossible to obtain due to its poor condition, etc.

Making payments on time and not having to chase the buyer is the primary focus but what happens for penalties if the buyer does not is addressed six ways from Sunday. You pay you stay, you don’t you won’t simple.

Talk to a Maine attorney to discuss the latest foreclosure laws on owner financed land.

To learn how the process works if you have to pull the plug and yank back the land. Installment sale, a land contract is another mechanism for owner financing Maine land.

It works a little differently than the just give a deed, take back a mortgage and the seller has a little more of an upper hand.

To be a tad quicker on the draw if there is a foreclosure show down at high noon on Main Street so to speak.

In Maine, there is not a lot of difference. But whatever makes the parties more comfortable buying and selling in an owner financed land sale situation should be done to hold the transaction together.

Being two instead of three months payments behind to begin foreclosure is all in the fine print you discuss with the attorney you trust the most setting up the owner financing.

Make sure that legal beagle has experience in real estate, Maine land sales… because when they do not, the transaction wobbles.

Mistakes are made from just not practicing in their area of expertise.

Red flags and pit falls to owner financed Maine land? I ask a lot of questions and the answers determine whether this is a good idea or not with each and every individual land buyer and seller. The Maine land buyer who wants to go no money down, to roll his legal fees and prorated share of the property taxes into the payment is dangerous.

He has no skin in the game and the lack of financial commitment is a sign to expect potential problems ahead in zero or very little down payment playing the owner financing game.

Like the renter who does not provide a security deposit, does not have to belly up to the bar and plop down first and land month’s rent as well.

Then the risk increases when the upfront money is missing in negotiations to add strength to the chances of success not foreclosure.

If a buyer can not get a loan of any kind, when they tell me their credit is shot, their debt ratios are through the roof and they are in the middle of a nasty divorce. Oh and just lost their job and have some major medical hurdles to clear too.

It is impossible to recommend them to a seller as a quality Maine land owner financing candidate to link up with in a property sale if lots of financial credit history drama in the background.

It is nothing against the Maine land buyer personally, but their financial state that makes them too big a risk shakey.

The rules in the mortgaged land the buyer is month by month slowly paying off also will state the property can not be sold off before the land is free and clear.

Or without written permission of a loan assumption which is rare on Maine land or any real estate mortgage.

Unless it is improving a poor performing hit or miss buyer with one that adds more money or a better payment frequency to the re-worked land sale.

People have life experiences that hit hard and that impact the best of intentions when entering into a land sale owner financed arrangement. We work around them as a Maine real estate broker with forty years experience to draw from in each and every approach to an owner financed land sale.

What are the costs in the Maine land sale with seller financing?

In my area, the land owner usually pays for the deed of conveyance, their half of the transfer tax required to record the deed of conveyance at the registry of whatever county the property is located. The buyer and seller typically pro-rate the current tax year bill. The buyer pays the attorney crafting his side of the owner financing arrangement mortgage and promissory note plus picks up the legal bill for the title search.

Cut over wood land that was recently harvested is the easiest to obtain attractive owner financing on when buying Maine acreage. The seller figures the new buyer can not hurt it much because the timber value today is gone.

And if a well is drilled, a septic system, power, driveway and a vacation camp or something more grandiose is added, it just improves the seller’s exposure risk on the mortgage collateral securing the land installment sale. Recently cut over, cheap Maine land usually comes with attractive owner financing terms to make it easy peasy to purchase.

People buy land for many reasons.

Some for the simple low cost vacation destination to run away from the daily pressure of  city living. Trading it in for a short spell of time over a long holiday weekend or yearly week of vacation time in rural Maine. Other land buyers want to build new, start fresh and homestead in Maine.

city living. Trading it in for a short spell of time over a long holiday weekend or yearly week of vacation time in rural Maine. Other land buyers want to build new, start fresh and homestead in Maine.

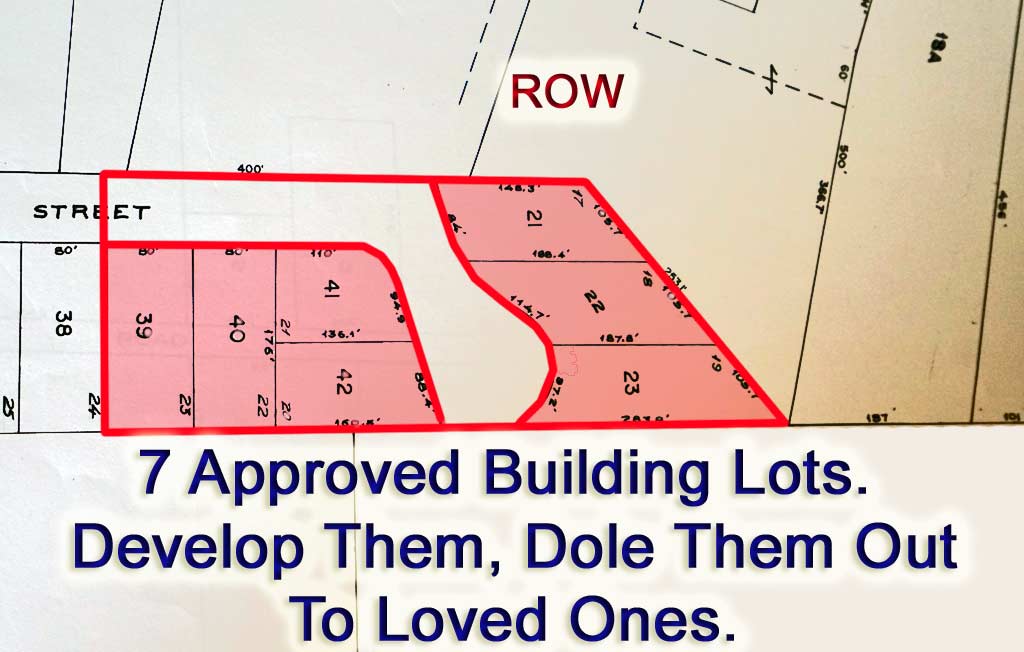

Or park it on a lake in retirement mode. Some just want a solid investment that can be left to their children later in life or sold fairly quickly if developed in a subdivision for a tidy profit. The dream to live off grid, to set up a simple farmstead and grow what you eat for healthier living is a strong one.

Maine land is low cost, large sized and uncrowded for population to mess up your space.

Regardless of the strong motivation and the many good reasons to buy low cost Maine land, owner financing is just the cherry on top.

To make it very easy to custom make payments to fit the buyer’s budget. So before you know it, own land that is payed off and highly enjoyed. If you are searching for owner financed Maine land, MOOERS REALTY has all locations, prices, sizes and types of acreage to consider!

I’m Maine REALTOR Andrew Mooers, ME Broker

207.532.6573 | info@mooersrealty.com |

MOOERS REALTY 69 North ST Houlton ME 04730 USA